Yes, there is a class action lawsuit against Vivint, a smart home company that provides security devices and monitoring services. The lawsuit alleges that Vivint violated federal laws by misusing credit reports and opening accounts without authorization.

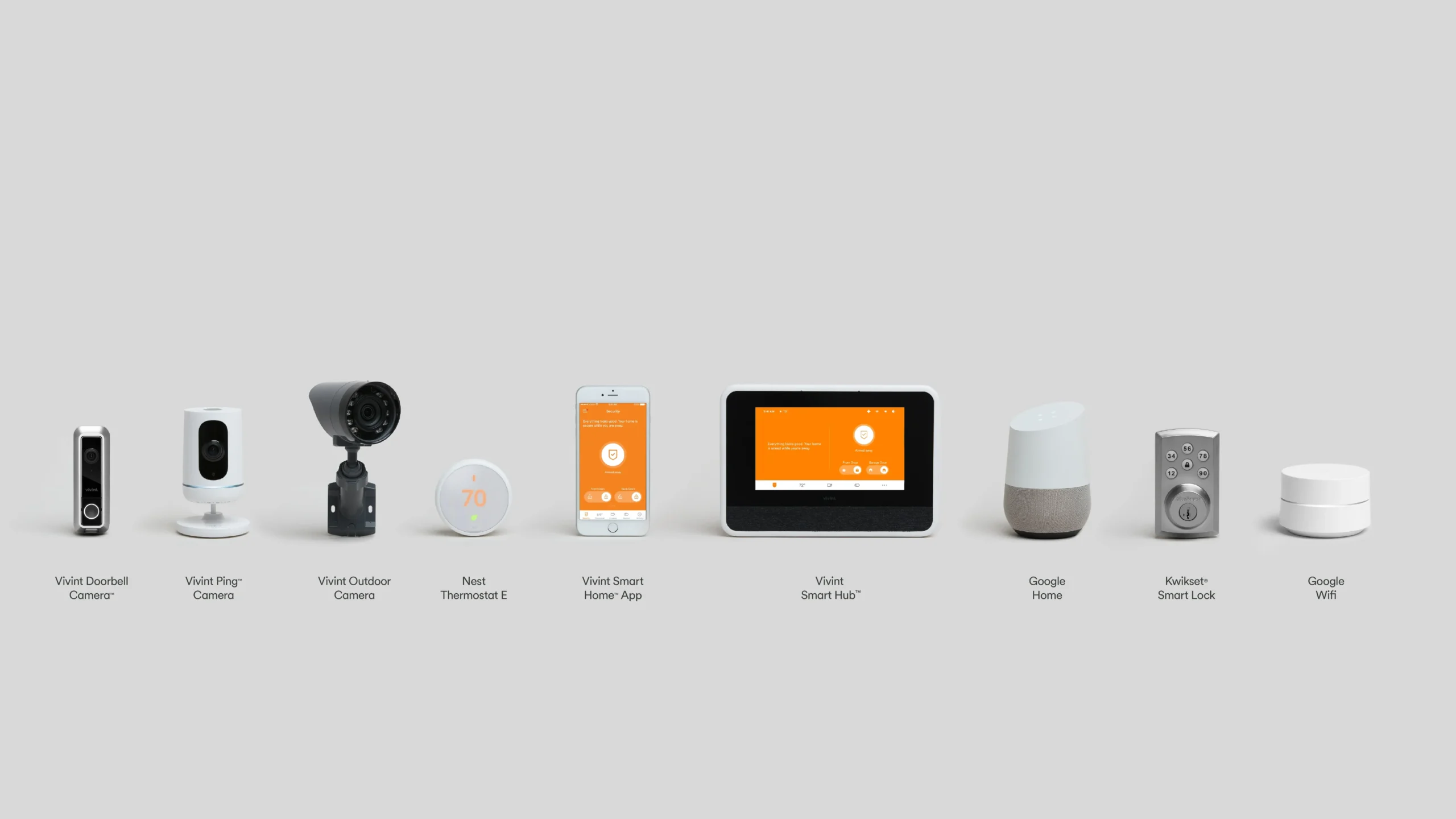

Vivint is one of the largest providers of smart home technology in the U.S. and Canada, with more than 1.5 million customers. However, the company has also faced numerous complaints and lawsuits over its sales and business practices. In this article, we will explore the details of the class action lawsuit against Vivint, the potential damages and refunds for affected consumers, and the steps to join the lawsuit or file a claim.

What is the Class Action Lawsuit Against Vivint About?

The class action lawsuit against Vivint was filed by the Federal Trade Commission (FTC) in April 2021. The FTC accused Vivint of violating the Fair Credit Reporting Act (FCRA), the FTC Act, and the Red Flags Rule by engaging in two illegal schemes to help unqualified customers get financing for its products.

According to the FTC, Vivint’s door-to-door sales representatives used a proprietary system called Street Genie to check the credit reports of potential customers. If the customer did not qualify for financing, the sales reps would use one of the following methods to bypass the credit check:

- White paging: The sales rep would use the white pages to find an unrelated person with a name that was the same as or similar to the customer who failed the credit check. The sales rep would enter that unrelated person’s address as a “previous address” in the Street Genie app and re-run the credit check. In effect, the sales rep would trick the system into approving a new account for an unqualified customer by illegally using the credit history of a random person who had the same name and a better credit score.

- Co-signer fraud: The sales rep would ask the customer who failed the credit check for the name of someone else, such as a relative. The sales rep would then pull the credit report of that person without their permission and add their address in the “previous address” field, thereby qualifying the primary account holder. In some cases, the sales rep would add a co-signer on the account that the primary account holder did not know, but that the sales rep thought could pass the credit check.

These schemes resulted in thousands of consumers having Vivint accounts opened in their names without their knowledge or consent. Many of these consumers discovered the unauthorized accounts when they checked their credit reports, received bills from Vivint, or were contacted by debt collectors. Some of these consumers suffered negative impacts on their credit scores, their ability to obtain credit, or their eligibility for government benefits.

The FTC alleged that Vivint’s conduct violated the FCRA, which requires companies to obtain a consumer’s written permission before accessing their credit report, and to provide accurate information to credit reporting agencies. The FTC also alleged that Vivint violated the FTC Act, which prohibits unfair or deceptive acts or practices in commerce, and the Red Flags Rule, which requires companies to implement identity theft prevention programs.

What is the Settlement Agreement Between Vivint and the FTC?

In August 2021, the FTC announced that it had reached a settlement agreement with Vivint to resolve the class action lawsuit. Under the settlement agreement, Vivint agreed to:

- Pay $20 million to the FTC, which will be used to provide refunds to affected consumers.

- Stop using the Street Genie system and any other system that allows sales reps to bypass credit checks or open accounts without authorization.

- Implement a comprehensive identity theft prevention program and obtain third-party assessments of its compliance every two years for the next 20 years.

- Notify consumers who may have been affected by its conduct and provide them with instructions on how to dispute or cancel their accounts, remove any negative information from their credit reports, and obtain a free credit report.

- Cooperate with the FTC in its ongoing investigation and enforcement actions against Vivint’s sales reps and other parties involved in the schemes.

The settlement agreement is subject to court approval and public comment. The FTC will publish a notice in the Federal Register and accept public comments for 30 days after the notice is published. After that, the FTC will decide whether to make the settlement agreement final.

How Can I Join the Class Action Lawsuit Against Vivint or File a Claim?

If you are a consumer who had a Vivint account opened in your name without your authorization, you may be eligible to join the class action lawsuit against Vivint or file a claim for a refund. Here are the steps you can take:

- Check your credit report: You can obtain a free credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) once every 12 months at www.annualcreditreport.com. You can also get a free credit report if you have been a victim of identity theft or fraud, or if you have been denied credit, insurance, or employment based on your credit report. You should review your credit report carefully and look for any accounts or inquiries from Vivint that you did not authorize. If you find any errors or discrepancies, you should dispute them with the credit reporting agency and Vivint as soon as possible.

- Contact Vivint: You can call Vivint’s customer service at 1-800-216-5232 and ask them to verify if you have an account with them. If you do, you can ask them to cancel the account, remove any charges or fees, and delete any negative information from your credit report. You can also request a confirmation letter or email that shows that the account has been closed and the credit report has been corrected. You should keep a copy of this letter or email for your records.

- File a claim online: The FTC is sending claim forms to more than 9,000 consumers who may be eligible for a refund from the settlement. If you received a claim form, you can file a claim online at www.vivintrefund.com/File-a-Claim. You will need to provide your name, address, phone number, email address, and the claim number that is printed on your claim form. You will also need to answer some questions about your experience with Vivint and upload any supporting documents, such as your credit report, your confirmation letter or email from Vivint, or any other evidence that shows that you had an unauthorized account. You must file your claim by January 19, 2024.

- If you did not receive a claim form, but you believe you are eligible for a refund, you can call the refund administrator at 1-833-472-1996 and ask for a claim form. You can also visit www.vivintrefund.com for more information and updates on the settlement.

What are the Benefits and Risks of Joining the Class Action Lawsuit Against Vivint or Filing a Claim?

If you join the class action lawsuit against Vivint or file a claim, you may be able to receive a refund from the settlement. The amount of your refund will depend on several factors, such as how many consumers file a claim, how much you paid to Vivint, and how much harm you suffered from the unauthorized account. The FTC estimates that the average refund will be around $2,200 per consumer, but some consumers may receive more or less.

However, joining the class action lawsuit against Vivint or filing a claim also has some risks and limitations. For example:

- You will give up your right to sue Vivint individually or participate in any other lawsuit against Vivint related to the same issues. You will also give up your right to appeal the settlement or any court orders related to the settlement.

- You may not receive a refund or you may receive less than you expected. Filing a claim does not guarantee that you will receive a payment. Your claim will be reviewed and verified by the FTC and the refund administrator. If your claim is approved, your payment amount will depend on the available funds, the number of valid claims, and the extent of your damages. There is no guarantee that there will be enough money to pay all claims in full. If there are more claims than money, the payments will be reduced proportionally. If there are fewer claims than money, the FTC may use the remaining funds for further consumer redress, consumer education, or litigation.

- You may have to wait a long time to receive your payment. The FTC does not have a mailing date yet for the payments. The FTC will update its website when it has more information. The payment process may take several months or longer, depending on the number of claims, the verification process, the court approval, and the distribution process.

Conclusion

Vivint is a smart home company that faces a class action lawsuit from the FTC for violating federal laws by misusing credit reports and opening accounts without authorization. The FTC and Vivint have reached a settlement agreement that requires Vivint to pay $20 million to provide refunds to affected consumers, stop its illegal practices, implement an identity theft prevention program, and cooperate with the FTC’s investigation. Consumers who had unauthorized accounts with Vivint may be eligible to join the class action lawsuit or file a claim for a refund. However, they should also be aware of the benefits and risks of doing so, and follow the instructions and deadlines provided by the FTC and the refund administrator.